Factor investing #5: Equity factor exposure

Since CN&CO is very involved in many aspects of the financial services industry, we often come across useful and informative articles that we believe our friends and partners will be interested in reading. The latest is a series of articles compiled by Jason Swartz – a member of the team at our partner Satrix – that unpack the concept of factor investing and how it’s used in different situations. We will be publishing an article a week on our blog for the next several weeks. Technical investors, keep an eye out!

Factor investing is one of the tools used by portfolio managers to maximise returns in an investor’s portfolio. Factors employed vary from portfolio to portfolio and from manager to manager. A momentum strategy, for example, focuses on trends in share prices, whereas a value investor would look specifically for shares that he or she believes to be undervalued in the market. More definitions are available here.

This week’s article outlines equity factor exposure in a multi-asset portfolio.

Adding equity factor exposure to a multi-asset portfolio

By Jason Swatrz

Client level of adoption/allocation:

Factor investing has the ability to empower consultants, multi-managers and advisors to build client portfolios simply and efficiently.

From 1) the transparent manner in which factor portfolios are systematically constructed, to 2) the capability of building tailored investment outcomes with greater diversification and predictability, to 3) the low fees, to 4) the reliability in consistently delivering a specific investment philosophy. Factor investing is beginning to revolutionise the investment industry.

While the potential impact of factor investing is transforming in nature, the level of adoption by clients varies by degree of simplicity, from ‘not allocating’ to ‘sophisticated allocation’. In this series we aim to highlight all applications of factor investing across this continuum.

This article is the fifth in our series of articles aimed at discussing practical ways to employ the power of factor investing. In our previous article, we discussed blending factors via strategic allocations to each factor to achieve a diversified equity portfolio.

In this article, we look at using a factor-based equity portfolio (as discussed in the previous article) as an alternative to the traditional passive or active equity component within a multi-asset portfolio.

Multi-asset products have seen a significant upswing in popularity over the prior decade, and thus have become more mainstream in the asset management industry, both domestically and globally. Along with their increasing acceptance, multi-asset investing has seen substantial innovation in portfolio construction, including the inclusion of passive/index building blocks, being more ‘solution orientated’, as well as replacing the traditional asset allocation with ‘exposure allocation’.

All of these advances have assisted in making investment decisions that have a stronger emphasis on building more reliable and predictable investment outcomes. A further practical innovation is substituting the equity component of the multi-asset fund with a blend of factor exposures.

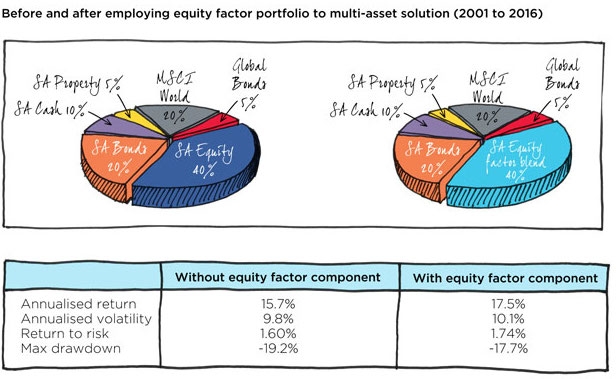

Figure 1:

Source: Bloomberg, Barra, Satrix: April 2017

In Figure 1, we illustrate the impact on the overall fund from a historical risk and return perspective, and find that the annualised return increased from 15.7 to 17.5% and subsequently the risk adjusted return improved from 1.6 to 1.74 over the prior 15 years.

Interestingly, the maximum drawdown of the fund also decreased from 19.2% to 17.7%. This is indicative that the equity factor blend embodies strong diversification characteristics through lower correlations to other asset classes. This is particularly beneficial to the fund during periods of market stress, where the equity component ultimately determines the fund’s drawdown. Typically, a factor-constructed equity component can be constructed to be made up of more defensive characteristics than index or active managers, by virtue of blending uncorrelated factors together in an optimal way.

In our view, using factor building blocks is a natural extension of passive multi-asset solutions, given the tailwind of financial innovation and product development in this space. A key principle of how we build multi-asset portfolios that aligns with our view on building equity factor portfolios, is applying strategic allocations to asset class weights, as we do with factors allocations. Our view is supported by a host of academic and practitioner research that says strategic asset allocation is the most important decision to performance, contributing to anywhere from 80% to 95% of portfolio returns. Added to this, the numerous supporting empirical studies that have found only a minority of managers possess significant asset allocation / market timing skills.

For more information on this topic, or our Satrix Balanced Index fund (built on the framework of this article) please feel free to contact us directly.

In our next part in the series, we will discuss the application of tactically adjusting factor tilts to express an investment view in your portfolio.

Watch the video below for more info on adding equity factor exposure to a multi-asset portfolio: