Wrapping up 2023 with InsureTalk38

InsureTalk38 was the last edition of the webinar franchise for the year 2023. It took place on 23 November, just under a month after the first ever InsureTalk Live event. MC Christelle Colman told guests that CN&CO Events would be hosting two InsureTalk Live events in 2024, so look out for those! The first online InsureTalk for 2024 will take place in February.

You can book for InsureTalk 2024 here.

InsureTalk38’s theme was “Accelerating horizons: embracing AI, resilience and reflections in insurance”. The event partners were SSP and Insdi.

“We are going to talk about how AI is going into the next phase and how it’s reshaping the insurance landscape,” said Christelle. “As holidays approach, insurers and brokers find themselves delicately balanced in reflection and action, pondering the past year’s lessons while forging ahead into an uncertain future. It’s been a volatile year for insurers, underscoring the need for adaption, resilience and proactive measures in safeguarding the industry and its stakeholders and policyholders.”

First up was Joel Rothman, co-founder and insurance technology advisor at insdi. Joel’s theme was “Instant digital – AI shifts into second gear”.

He spoke about ChatGPT and how it has developed in the past year. Artificial general intelligence is expanding at a rapid rate, he said, warning guests that it should be used responsibly.

“We need to learn to fact-check its outputs,” he said, “and remember never to send private information to public AI services.”

He went through several examples of how to use the new ChatGPT to make life easier for insurers, including a discussion on the large language model (LLM) that the platform uses.

“You give it an instruction in natural language and AI takes care of the tools and the tasks required to achieve the outcome.”

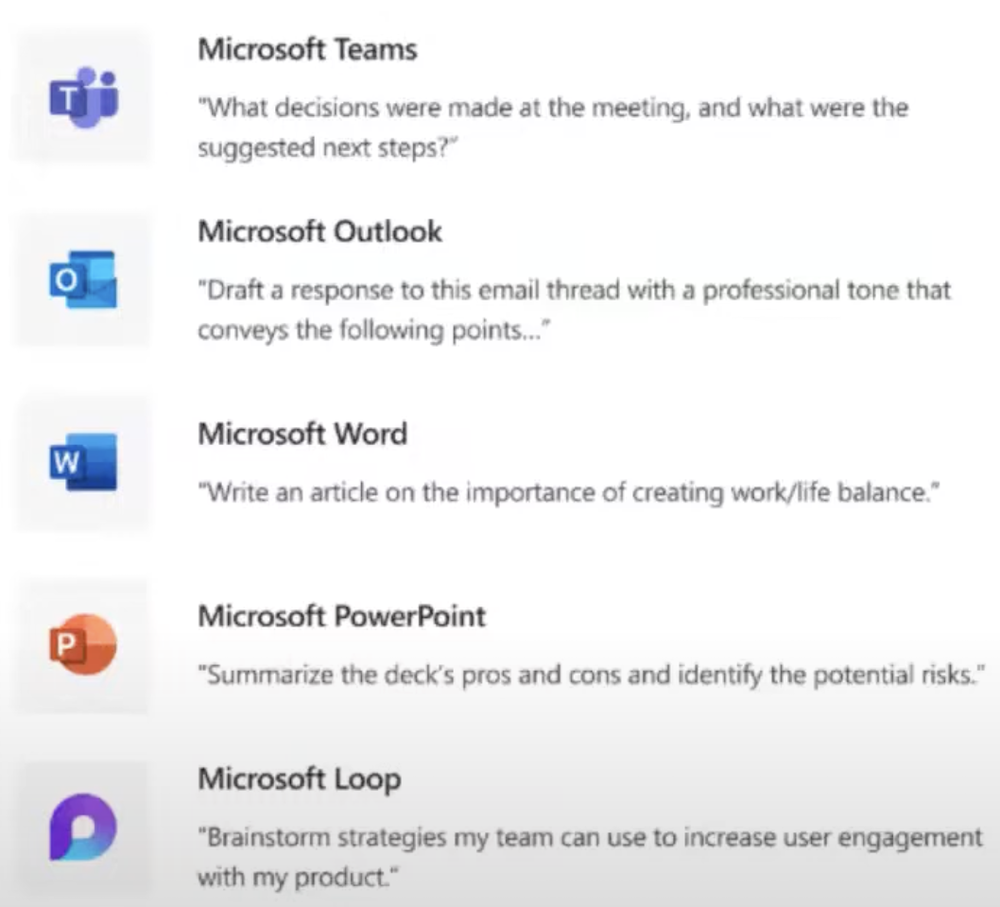

He used examples of Google Home, the Humane AI pin and Microsoft’s Copilot (as shown in the image above) to illustrate how this technology can make life easier, and how it can make work more productive.

FIA director Peter Olyott was up next. He spoke on catastrophes, and what they mean for an intermediary.

“The reasonable broker standard on catastrophes has been raised,” he said. “My advice is, if you’re not going to pay too much attention to catastrophes, run for the hills!”

Here’s the high level of what Peter’s talk focused on:

“We’ve always had floods,” he said. “At the turn of the century we had one storm measuring 600mm in one day – surpassing the April 2022 floods in volume. Having said that, weather patterns have definitely changed over the past 40 years or so. But over the past 220 years, we have had about 1000 hazardous events, the majority of which have been related either to wind or floods.”

The built environment is in decay and the stagnant economy creates an ideal situation for an increase in crime.

Looking back and looking ahead

Covid 19 taught us a lot of lessons, said Peter. Brokers tended not to be too focused on Sasria before Covid hit, while the KZN floods highlighted the fact that risk mitigation was wanting. He also posed some poignant questions about the possibility of public grid failure. For the next four years, Peter sees changing weather patterns as an evolving risk, as well as carbon emissions, urban decay, fires, storms, public unrest, cyber crime, the increasing cost of car ownership and other motor risks, and wars and conflicts.

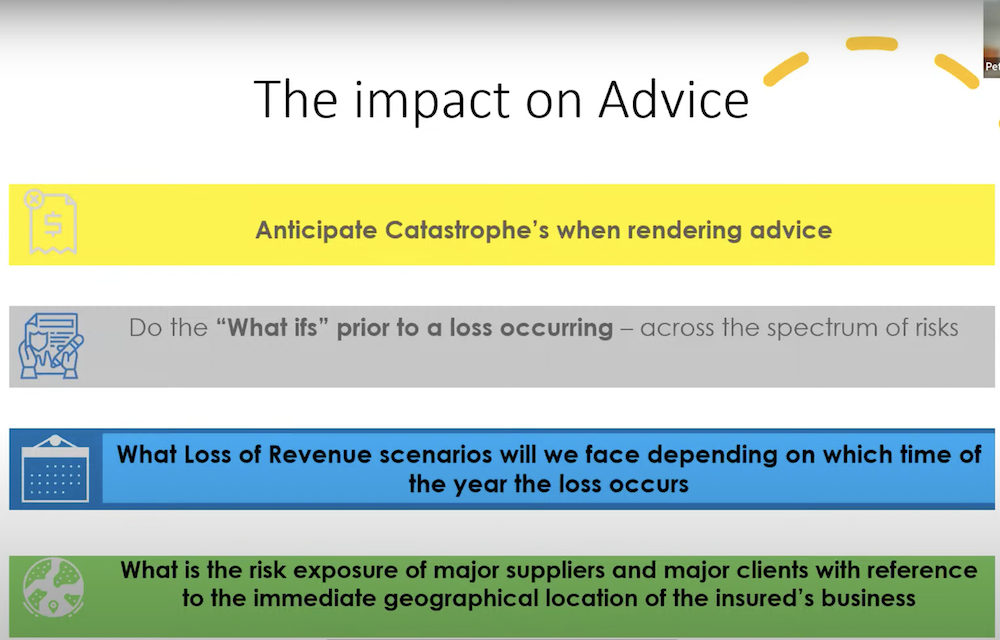

Here’s how Peter says these risks will impact on advice:

“Insurance is a detail game,” he said. “We need to use what we know already to plan for events that may or may not happen. Practise how everything will work before it happens. You will be glad you did!”

The IISA’s Thokozile provided her traditional update on what’s happening at the association. In her talk she highlighted some of the IISA’s successes during 2023. These include the IISA’s level 1 BBBEE rating, which was achieved by being intentional about incorporating transformation into all the association’s activities in line with the pillars of the B-BBEE Act. The IISA also got its SAQA licence renewed – a rigorous process that takes place every five years – and has accredited almost 800 new members as at the end of October thanks to a committed membership drive.

Thokozile also reminded delegates to register for the 50th AIE conference, which takes place at Sun City in July 2024. You can register at www.iisa.co.za. Early bird registration closes on 6 December.

Rianet Whitehead of FA News and The Insurance Apprentice gave an overview of the content of the latest FA News magazine. (You can read it here.) She complimented the IIG Annual Gala Dinner, which took place two weeks before InsureTalk38. She called on Gauteng-based women in the industry to consider joining the GWII, which she called “a fantastic platform for women to connect and grow on a whole lot of different levels.”

The Insurance Apprentice is in its 10th year and preparations for the 2024 season are in full swing. Sponsorship options are still available for anyone interested. Episodes will be aired in late February and early March.

Our entertainment for the day was provided by accomplished musical theatre performer Qondea Avril Mkansi.

Marcia Le Roux, business development manager for SSP in Africa, spoke on how technology can help insurance professionals to navigate the delicate balance of time, leaving them with more time for themselves and improving work-life balance.

“As we unite in our shared dedication to the happiness and contentment of our policyholders, it becomes crucial to take a moment and reflect on our own well-being as insurers and brokers. With the holiday season around the corner, a time linked with joy and connection, it prompts us to stand at a crossroads where our professional commitment meets our personal desire for rejuvenation.”

She said incorporating software platforms can enhance efficiency for clients and create opportunities for insurers and brokers to reclaim time for personal values. Her talk focused on five technological aspects that can enhance client efficiency and ultimately improve quality of life for everyone involved in the insurance value chain.

“In the dynamic realm of the insurance industry where safeguarding others is our mission, let us not forget to extend that same commitment to ourselves,” she said. “Just as we diligently finalise corporate commitment and policies to secure the well-being of our clients, let us also craft an insurance policy for our own lives – one that insures the precious moments, the laughter and the warmth of the holiday season.”

The last slot was filled by three speakers from Swiss Re: Hayley Schell, regional manager P&C Southern Africa; Priyen Metha, head of P&C sub-Saharan Africa and Ismaeel Adams, regional manager P&C Southern Africa. Their topic was “The power to protect: grid failure through the lens of risk transfer and mitigation”.

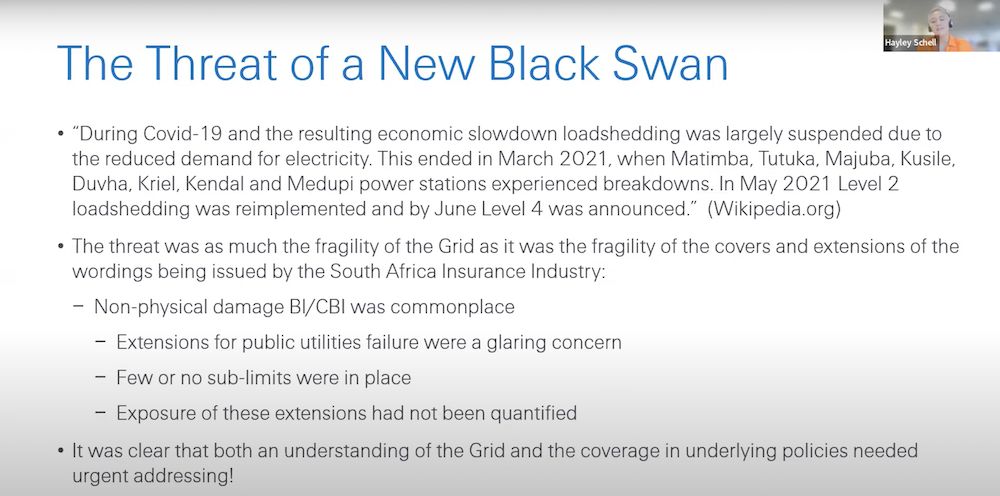

Hayley was first. She explained how Swiss Re had been deliberating the pain of Covid losses on their balance sheet in 2021 when they started wondering, what could be next? This, she said, was the threat of the potential failure of the national grid.

“Similar to Covid, we saw it a black swan event,” she said, “and asked ourselves, ‘what could the severity of that event look like?’

She said the perfect storm is created or exacerbated when the policy wordings sell extensions without proper cognisance of their impact.

Using Covid as an example, she explained, “When infectious disease wording was designed and incorporated into commercial policies and asset all-risk policies, we were really thinking of something along like salmonella in the kitchen. We were not thinking of a global lockdown.”

These were the threats identified by Swiss Re:

The team the played out a number of scenarios in an attempt to quantify the potential loss of a complete grid failure.

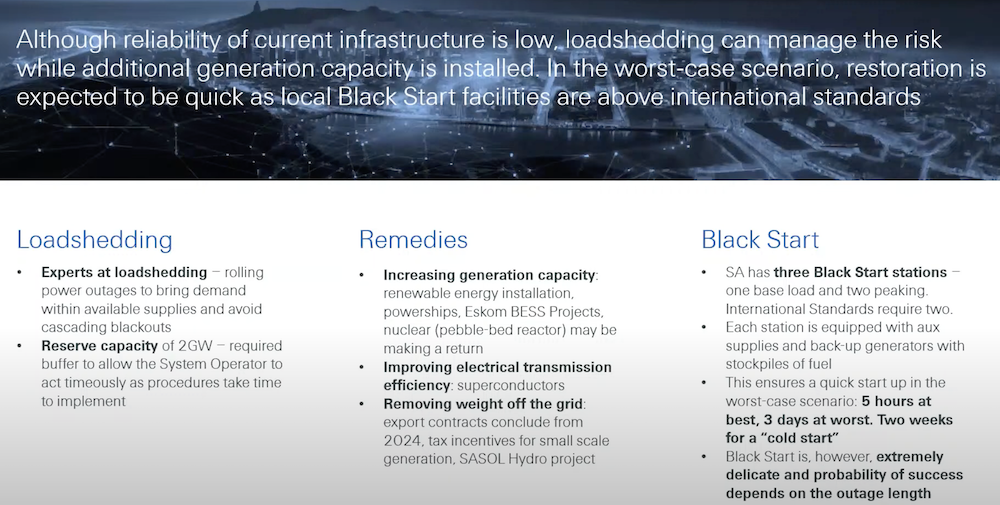

“Our issue was to identify whether this black swan event would be a capital or solvency issue for the South African market. So we looked at the insurance and reinsurance balance sheets to help us understand this question, said Priyen. He gave a history of the power grid and discussed how load shedding has prevented grid failure so far.

The team emphasised their findings that the likelihood of grid failure is low, but pointed out that other commentators place grid failure as the number one business risk in South Africa. So Swiss Re did some calculations and estimated that the cost of a grid blackout in South Africa would be around US$40bn, which is way more than our economy can sustain and which would certainly result in the insolvency of the local insurance market. This is why reinsurers have introduced grid failure exclusions in their treaties.

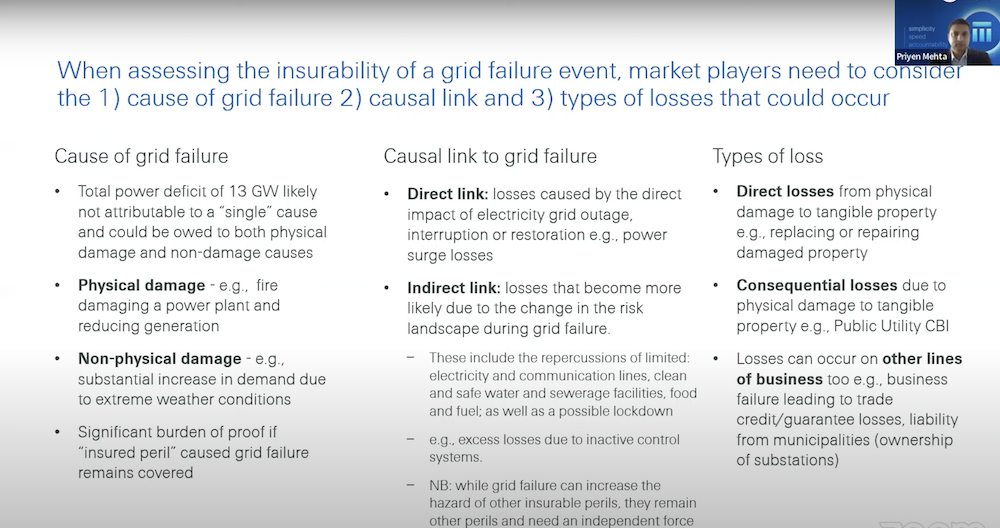

Ismaeel unpacked the considerations that need to be taken into account when assessing the insurability of a grid failure event:

He went on to explain Swiss Re’s grid interruption exclusion and shared the company’s assessment criteria for accepting a market wording.

Christelle closed the session by reminding delegates to ensure their life admin is in oder before setting off for their holidays, before handing over to CN&CO’s Carel Nolte. Carel thanked guests for their support during the year, as well as thanking Christelle, Llewellyn and the team and CN&CO Events for their hard work behind the scenes.

(Carel came to us live from the back of an Uber, proving that you can watch and engage with InsureTalk wherever you are!)

Here’s the booking link again for InsureTalk 2024: https://bit.ly/InsureTalk2024. And if you would like to watch the recording of InsureTalk38, click on the video below: