Technical and softer issues addressed at InsureTalk40

InsureTalk40 took place on 14 March 2024. Host Christelle Colman opened proceedings. “I actually can’t believe it’s been forty episodes since we started this back in the dark days of lockdown!” she said.

The theme, “Ensuring Tomorrow: Bridging Experience, Technology, and Sustainability in the Ever-evolving Insurance Landscape,” was particularly relevant as we embark on another year of growth and productivity.

Big thanks to our long-standing event partners SSP and Global Choices, whose contributions enable us to offer this conference at no cost.

Our first speaker was Wimpie van der Merwe, CEO of Global Choices. He shared his insights on “Exploring the Advantages of the Experience Economy in the Insurance Industry.”

His talk delved into the fundamental shift needed to move away from the commoditised perception of insurance and called for the creation of transformative experiences for customers.

He emphasised how insurance, despite its essential role in providing support during times of distress, “… has been reduced to a commodity, a necessity, with little differentiation between competitors.”

Wimpie highlighted the importance of understanding the experience economy, which focuses on the transformative impact of goods and services on people’s lives, distinct from traditional commodities.

He went on to stress the need for insurers to address customers’ emotional needs by exhibiting empathy, clear communication and prompt response to inquiries and claims.

Customers, he said, should also be educated.

“Insurance and brokers should focus on educating customers about their policies and helping them to grasp the significance of having adequate coverage,” he said. “Empowering customers to make informed decisions and streamlining their experiences can also significantly contribute to addressing the emotional requirements.”

Wimpie discussed the importance of adapting to the experience economy by focusing on consumer-centric strategies, using technology and data, and cultivating employee empowerment. He shared examples from companies like Amazon and Nokia, illustrating how customer-centric practices and innovative thinking can drive long-term success.

He concluded by encouraging continuous evolution and improvement in customer experiences, emphasising the role of empathy and curiosity in understanding and meeting clients’ needs effectively.

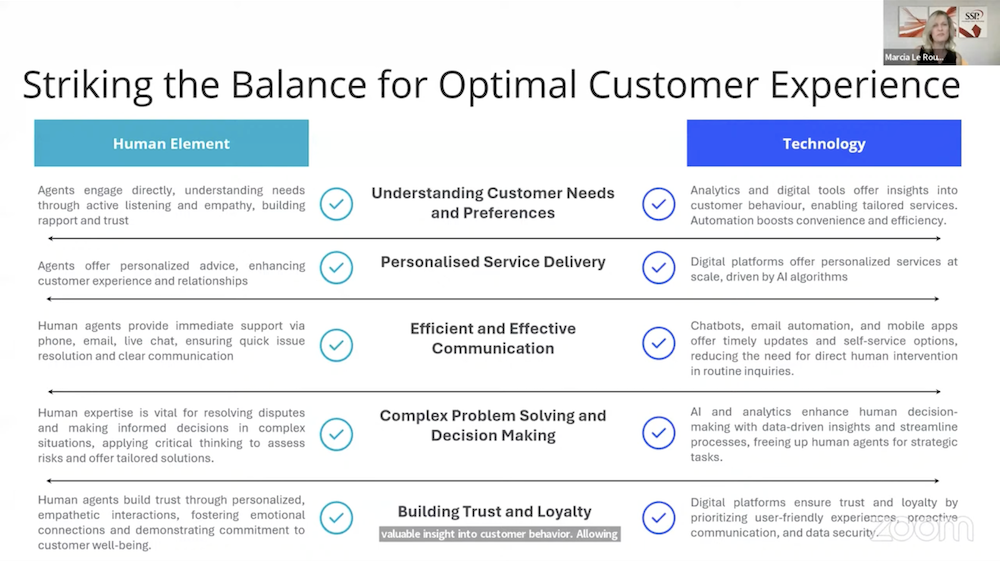

Marcia Le Roux, head of marketing for SSP Africa, provided very interesting insights on balancing the customer claims experience journey between the human element and digitalisation.

She shared a personal experience that underscored the challenges in achieving harmony between technological advancements and empathetic customer service.

“Despite submitting comprehensive documentation for two distinct claims related to damage caused by lightning, I found myself ensnared in a frustrating ordeal,” she said. “Mishandled cases, inconsistent communication and dismissive treatment left me feeling marginalised and unappreciated despite nearly a decade of being a loyal customer.

“These encounters underscore the need for enhancement in the insurance sector’s approach to claims management. complimented by the available technological support to enhance the insurance customer’s journey.”

Marcia stressed the pivotal role of the claims process as a moment of truth for customers, where trust can either be fortified or fractured based on their experiences.

“The remedy lies in leveraging both technology and the human touch to deliver unparalleled customer experiences,” she said.

Marcia highlighted key innovations offered by technology – such as centralised data storage, streamlined processes and automated notifications – as well as the irreplaceable human aspects of empathy, communication, negotiation skills and personalized support.

“By investing in both technological solutions and human capital, insurers can prevent negative experiences like mishandled claims and restore faith in the claims process, ultimately driving trust, satisfaction, and loyalty among customers,” she said.

Next up was IISA CEO Thokozile Mahlangu with her monthly update.

The talk kicked off with a reminder about the imminent closure of the CPD cycle within the next two months, underlining the importance of continuous learning and professional development.

“CPD is continuous learning. It’s investing in our knowledge, it’s investing in our skills, it’s making sure that we stay abreast of what is happening around us,” said Thokozile.

Thokozile underscored the significance of ongoing development rather than mere compliance.

“Continuing professional development is exactly that, continuing development and not just to do it a day before or the week before the cycle comes to an end so that you’re just compliant,” she said.

The upcoming African Insurance Exchange 2024 conference was singled out as an opportunity for further learning and networking. Thokozile invited participants to register for the conference to gain CPD accreditation and access thought leadership content from global experts.

The conference will once again be hosted by the incredible Tumelo Mothotoane, who recorded this intro video:

In closing, Thokozile reminded participants about the Black Broker Programme, designed to support upcoming black brokers and enhance their relevance in the industry.

“If you are a black broker, or if you know a black broker who could benefit from this programme, feel free to make contact with the IISA and we will gladly have a conversation with you.”

Rianet Whitehead is the co-owner and editor at FA News, as well as the brainchild behind The Insurance Apprentice.

March is Insurance Apprentice month! Season 10 of the popular insurance contest is now streaming, with new episodes dropping every Thursday night at 7pm. Click here to see what you’ve missed so far, and to watch each new episode as it airs.

Rianet also spoke about the pending CPD deadline of 31 May and encouraged guests to look out for the April edition of FA News to help them earn CPD hours to meet the deadline.

“It’s normally our edition with the highest open rates, views and readership compared to any other edition,” said Rianet. “Why? Because 31 May is CPD deadline and those who have not done their CPD hours consistently normally grab the April issue and work back.

“Every year the FA News website goes on a go-slow on 30 and 31 May because of users scrambling to get through their CPD hours!”

Rianet closed by encouraging delegates not to leave their CPD-gathering to the last minute.

Jasmine Minter provided a fabulous medley of popular tunes from the likes of Tina Turner and The Script, before handing the spotlight over to David Honeyman, who specialises in accident and health insurance at SHA.

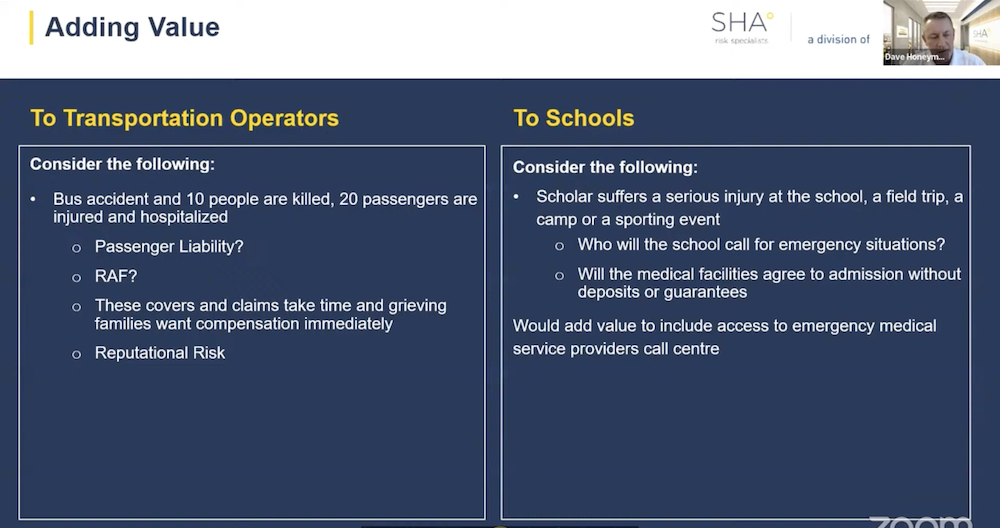

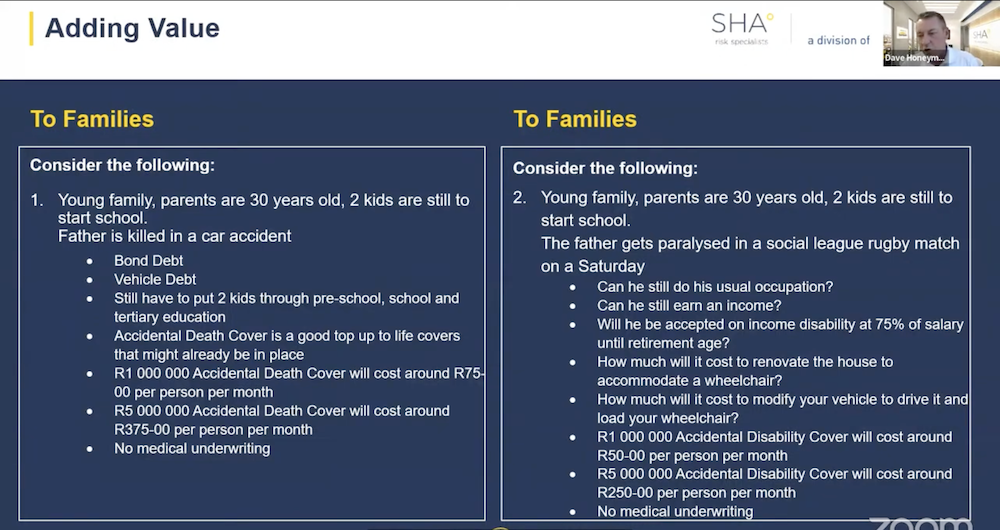

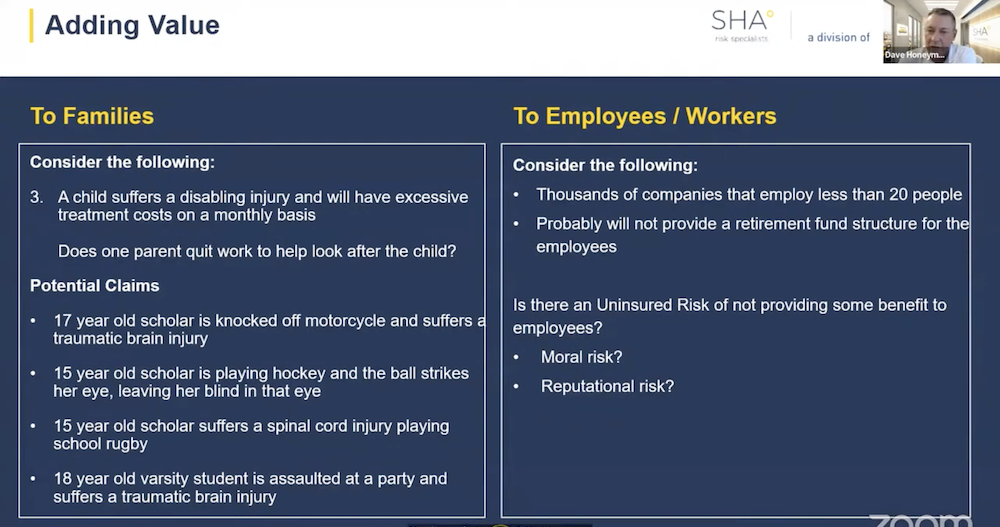

Dave’s talk focused on the versatility and value of personal accident insurance policies across various distribution channels and client industries. He spoke about the underutilised potential of PA insurance, expressing concern at how many brokers often overlook or lack sufficient knowledge about it and highlighted the opportunity to collaborate with brokers and clients to identify where this product adds value and how it can be tailored to specific industries.

Throughout the talk, Dave provided examples of how the same product can be adapted to meet the needs of different industries – from transportation operators seeking immediate assistance for injured passengers, to schools requiring emergency coverage for students, personal accident policies can be customised to offer solutions for various scenarios.

He stressed the importance of education and training to spark innovation and ensure that brokers and clients understand how to develop products that fit their needs.

Dave clarified a few misconceptions about personal accident insurance.

“It’s definitely not a replacement for retirement fund benefits,” he said. “It’s something completely different. It’s not a replacement for COID, contrary to popular belief. And it’s also not a replacement for a medical aid. So, we must stop thinking about those sides of it and then start looking at some of the ways that we think we can add more value.”

Dave supported his points with statistics on the prevalence of injuries in South Africa, demonstrating the relevance and necessity of such insurance.

He went on to discuss how personal accident policies can address the needs of families, individuals, and companies. He also explained the insurance industry’s role in assisting government efforts to ensure compliance with legislation related to compensation for occupational injuries and diseases.

In conclusion, Dave urged brokers to explore cross-selling opportunities between personal lines and commercial clients, with personal accident insurance standing as a valuable tool in bridging these markets.

“If brokers have the opportunity to cross-sell, the accident and health/personal accident space is a great place to interact between the commercial and personal lines spaces.”

Soul Abraham of Old Mutual Insure spoke about ensuring the sustainability of short-term insurance through technology and data. His talk covered a number of pressing issues facing the insurance industry, with a focus on sustainability. He structured his discussion around several key topics, including climate change, inflation, infrastructure challenges in South Africa, profitability of the intermediated industry and ideas for making the industry more sustainable.

Soul began by highlighting the significant impact of climate change on the insurance landscape, emphasising the increasing volatility and unpredictability of weather patterns.

He discussed the challenges faced by insurers when it comes to pricing climate-related risks accurately, especially in the face of events that occur more frequently than historical data suggests. Soul stressed the need for insurers to adapt their strategies and business models to address these evolving challenges.

Understanding exposure to climate risks at a granular level is vital, he said. Tools such as advanced flood models and geocoding techniques can be used to assess risk accurately. He said technology and data play a critical role in enabling insurers to better manage and mitigate climate-related risks.

“For example, if you’re insuring a house in a zone that’s prone to floods, wildfire and hail, our answer to that street, that suburb, might be very different to a suburb down the road where maybe it’s just flood risk or it’s just wildfire risk.

“This type of nuance is coming and it’s going to come down to a quote level,” he said. “It’s going to have to be a policy item level interaction, which means technology and data are going to play a huge role in the industry going forward.”

Soul also addressed the issue of underinsurance, pointing out that as insurance premiums rise due to climate-related factors, there is a risk of widespread underinsurance, particularly in regions with low insurance penetration like South Africa.

“We should be wanting more and more people insured, but climate change puts that at risk,” he said. “We’ve got a combat climate change. Net zero is a big word that’s coming up globally, everywhere.”

He said private and public stakeholders need to collaborate better to address these challenges effectively.

In addition to climate change, Soul discussed the impact of inflation and deteriorating infrastructure on the insurance industry. He highlighted the strain that rising claim costs and infrastructure deficiencies place on insurers, leading to increased premiums and reduced profitability. He called for innovative solutions, such as risk-based insurance pricing, infrastructure improvements, and customer-driven risk mitigation efforts, to ensure the sustainability of the industry.

Finally, Soul stressed the importance of data quality, agile underwriting and collaborative risk-sharing approaches and stressed the need for insurers to work together to develop tailored solutions that balance affordability with comprehensive coverage, while also empowering customers to take ownership of their risk exposure.

In closing, Christelle reminded guests to register on the InsureTalk website to manage their CPD hours and register for upcoming webinars.

InsureTalk41 Takes place on 18 April 2024 at 10am. You can register here for the next few months’ InsureTalk sessions. And watch your inbox for news of InsureTalk Live events in Johannesburg and Cape Town during the next 12 months.

If you missed InsureTalk40, you can watch it below. Remember to let Llewellyn know when you’ve watched it. He will send a few questions for you to fill in in order to be allocated your CPD hours.