Inoxico Trade Shield offers slick debtor management

CN&CO Events hosted a webinar for our friends at Inoxico to launch the latest version of the company’s Trade Shield offering.

Inoxico CEO Dominique Pitot welcomed guests, explaining that although Trade Shield was first launched in September 2021, the company had spent a huge amount of time with customers refining the initial product, but also “bringing into it our entire suite of innovative products, all focused on trade credit.

“We are going to be disrupting and transforming the industry of trade credit risk management and today is about showing you where that’s going,” he said.

Dominique went on to unpack the business of Inoxico in the trade credit space.

Nedbank chief economist, Nicky Weimar, was next up. She provided insights into the local and global economies and a glimpse into what lies ahead. And it’s not all doom and gloom!

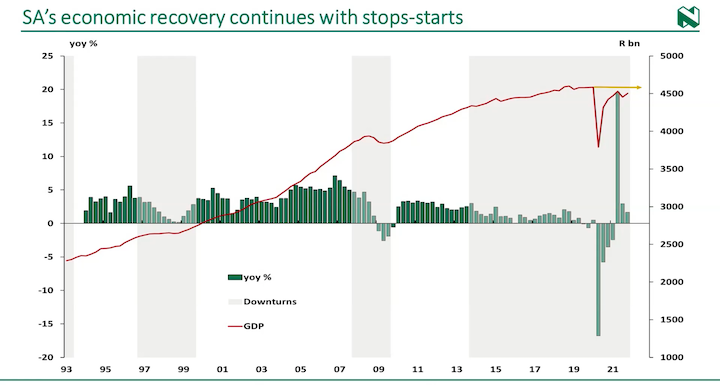

South Africa is actually in the process of recovering economically from the real shock that was level 5 lockdown in 2020.

“We have regained a lot of lost ground,” she said. “We are not back to pre-pandemic levels, though. In reality, it hasn’t been the smoothest recovery. It has also not been the most convincing among emerging markets. But we are very close to pre-pandemic levels.”

If trading conditions return to normal, she said, we should return to – or even exceed – pre-pandemic figures by the end of this year.

“Load shedding will continue to be a feature of our recovery going forward,” she said.

The Transnet data hack, the July 2021 riots and the recent floods in KZN and the Eastern Cape are other factors to consider in our economic recovery story.

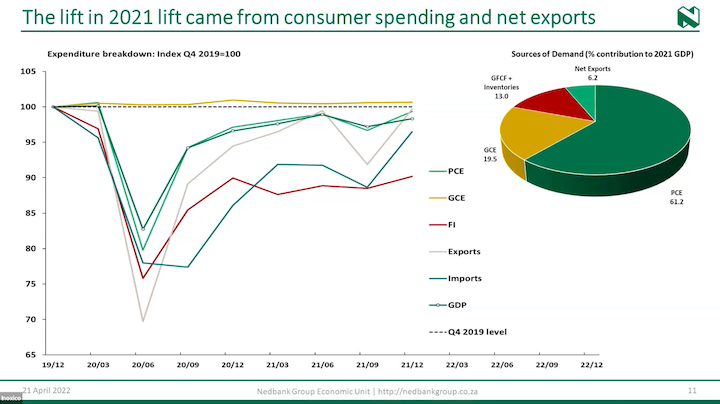

The lift in 2021 came from consumer spending and net exports.

“These have been the most powerful drivers of the economic recovery we’ve seen so far,” she said.

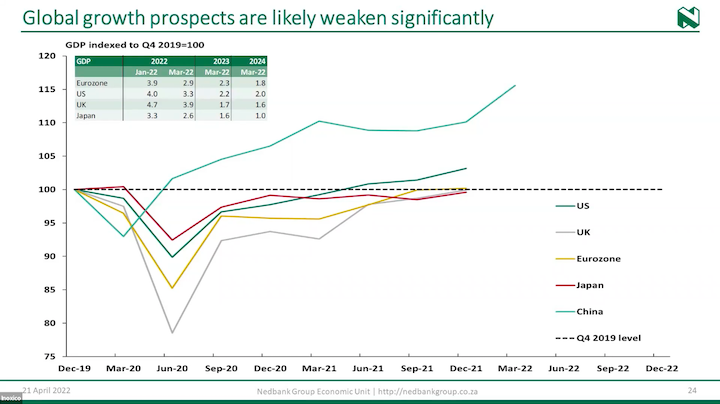

Nicky went on to unpack each of these drivers in detail and their impact on the economy, touching on commodity prices, inflation, the Russian war on Ukraine, oil prices, food prices, interest rates, global growth prospects, the rand’s performance, wage levels, fixed investment.

As for the year ahead, Nicky expects slower growth.

“We’re anticipating 1.9% growth this year, 1.7% next year and 1.3% the year thereafter. Generally speaking, it’s a modest growth picture. If we want to get higher growth numbers, it’s not impossible, but then we absolutely have to resolve our energy crisis.”

Inoxico chief revenue office, Ian Logan, followed Nicky’s presentation. He spoke about the need for a product like Trade Shield in the market.

“Our clients have a couple of needs. They want to make fast, profitable decisions and efficiently manage their debtors’ book. And that sounds very straightforward. But there are some challenges to that. The data is messy and scattered in different places, different databases. There are different feeds of data and it’s very difficult to aggregate that data. So it’s not that user friendly.

“The businesses lack models and technology to predict credit risk. ‘How much money should we extend to a potential customer?’ This causes friction between the sales and credit divisions.

“There’s also a lack of technology to automate the decision-making process and all of this means the process becomes very resource intensive and subjective as to what limits should be extended.”

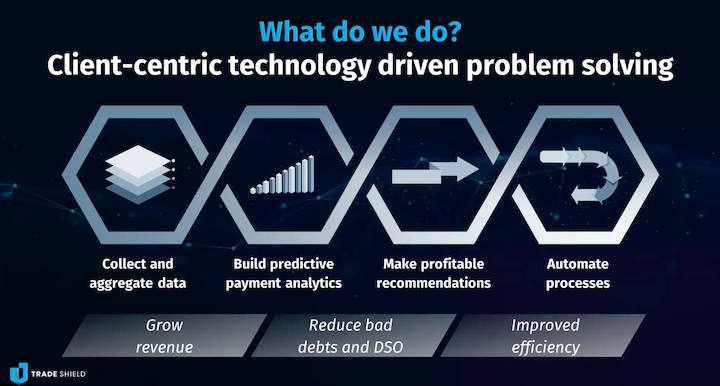

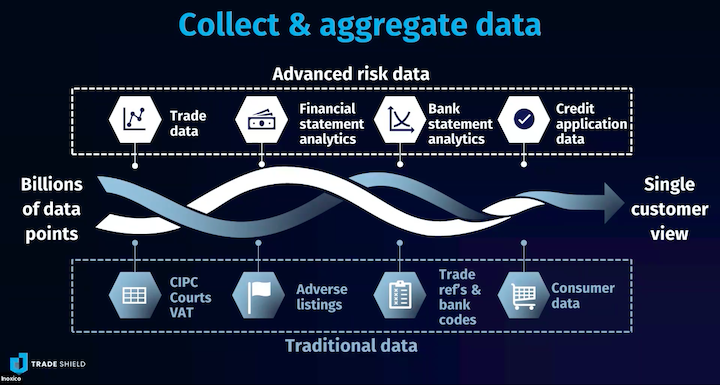

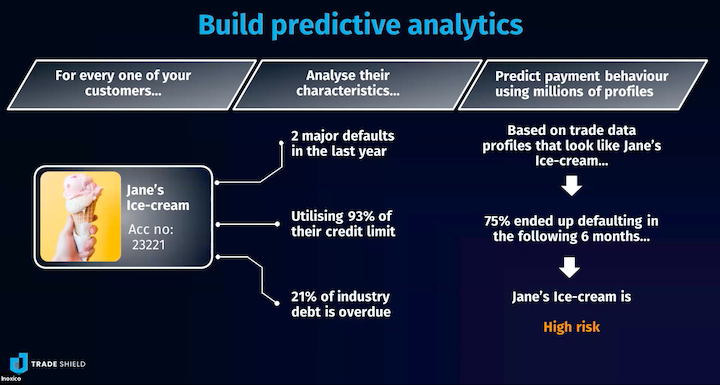

Trade Shield offers a holistic credit risk management solution and collects and aggregates data, builds predictive payment analytics, makes profitable recommendations and automates the process from start to finish.

Ian unpacked the elements of the service as per the slides below:

Ian took guests through a typical credit application process, from start to finish, demonstrating the comprehensive yet simple way that businesses are able to manage their debtors’ books. He finished off with a high-level, three-tiered pricing structure for businesses of different sizes.

The presentations were followed by a robust Q&A session with Ian and Dom.

To watch the full presentation, click here.

Comments 3

-

Monitoruj telefon z dowolnego miejsca i zobacz, co dzieje się na telefonie docelowym. Będziesz mógł monitorować i przechowywać dzienniki połączeń, wiadomości, działania społecznościowe, obrazy, filmy, WhatsApp i więcej. Monitorowanie w czasie rzeczywistym telefonów, nie jest wymagana wiedza techniczna, nie jest wymagane rootowanie.

-

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Szpiegowskie Telefonu

Szpiegowskie telefonu – Ukryta aplikacja śledząca, która rejestruje lokalizację, SMS-y, dźwięk rozmów, WhatsApp, Facebook, zdjęcie, kamerę, aktywność w Internecie. Najlepsze do kontroli rodzicielskiej i monitorowania pracowników. Szpiegowskie Telefonu za Darmo – Oprogramowanie Monitorujące Online. https://www.xtmove.com/pl/